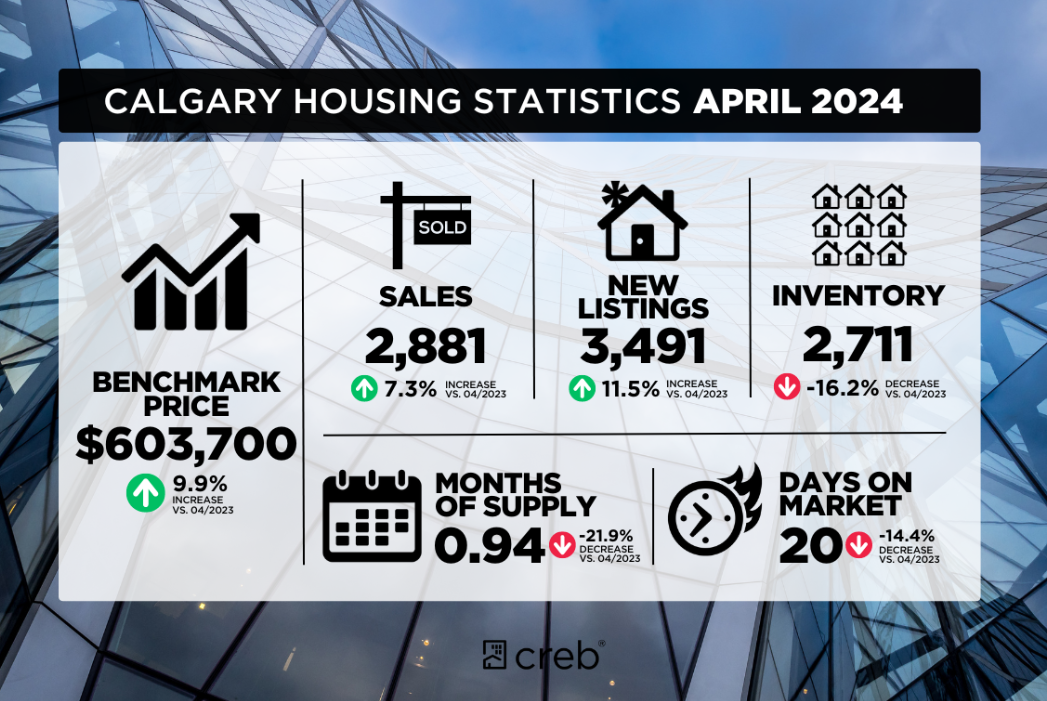

Taking a professional peek into Calgary’s real estate landscape for April reveals a scene ripe with activity. Sales clocked in at 2,881 units, showcasing a commendable seven percent uptick compared to the previous year. While growth moderated slightly from earlier months, the figures still soar 37 percent above the long-term April average. Notably, the surge in sales predominantly favored more budget-friendly, higher-density properties, indicating shifting buyer preferences.

Simultaneously, new listings surged to 3,491 units, marking an 11 percent increase year-over-year. However, this growth trajectory merely surpassed long-term April averages by a modest three percent. Despite the influx of new listings, the inventory remains relatively constrained, with 2,711 units available—a notable 16 percent decline from last year’s levels, representing half of the traditional April inventory.

Ann-Marie Lurie, Chief Economist at CREB®, provided valuable insights into the nuanced supply dynamics, noting, “While supply levels are declining, the predominant decline is observed within the lower-priced segment.” Homes priced under $500,000 witnessed a significant 29 percent drop in availability, while properties exceeding $700,000 experienced an uptick in listings. The prevailing high-interest rate environment is compelling buyers towards more affordable options while concurrently stimulating interest in higher-priced properties.

With a robust sales-to-new-listings ratio of 83 percent and a months-of-supply metric indicating scarcity, the market remains decisively in favor of sellers. In April, the unadjusted total residential benchmark price ascended to $603,700, reflecting a one percent month-over-month increase and a notable ten percent uptick compared to the previous year. Encouragingly, this price appreciation trend spans across all property types and districts, with the most pronounced gains observed in the more budget-friendly locales.